The rational investor is anything but. Every day, people make irrational decisions based on emotions — not because they aren’t smart but because of how they’re wired. Behavioral finance recognizes this challenge and gives financial advisors the tools they need to help their clients make rational decisions when they otherwise wouldn’t.

Because we don’t consistently act rationally, financial advisors need to tap into their clients’ emotions, fears and values to help them make financial decisions that align with those values. This process starts with figuring out what people value most. Hint: It’s not just money and wealth. Our “State of the Values” analysis looks at 85,000 people who went through a values card exercise. Family, health and happiness were the three most-cited values. Wealth and money, while important, didn’t make the top 10.

With that in mind, recognize that financial advisors have a powerful opportunity to help clients make rational decisions that align with their values and deliver better life outcomes. Learn more about what behavioral finance is, why it’s beneficial for clients and advisors, and how to implement it in your practice.

What Is Behavioral Finance?

Behavioral finance is the study of psychological and emotional factors that influence investor behavior and decision-making processes. It examines how cognitive biases, emotions, and social influences impact people’s financial choices. Behavioral finance seeks to understand why investors often deviate from rational decision-making models — and how these deviations affect their financial outcomes.

This field recognizes that investors aren’t rational and that their emotions can influence their investment choices. Fear, greed, overconfidence, anchoring bias, loss aversion and familiarity bias are just some of the emotional factors that lead to poor decision-making and suboptimal investment outcomes.

By studying investor psychology and understanding the role of emotions in financial decision-making, financial advisors can learn more about their clients’ motivations and provide more effective guidance and support.

How Behavioral Finance Differs From Traditional Financial Planning

Traditional financial planning primarily focuses on rational decision-making based on economic and financial principles. This investing approach assumes that financial markets are efficient and logical because the people participating are, too.

Behavioral finance theory is additive. It incorporates psychological factors, including cognitive biases and emotional influences, into the traditional financial planning process. Behavioral finance also recognizes that people will act irrationally — and they can’t simply will themselves to make rational decisions.

As think2perform CEO Doug Lennick has said, “our emotional intelligence literally cannot tell the difference between a bear market and a bear in the woods. Both bears will scare us: One of which is life-threatening, and the other is not.”

You also can think about traditional and behavioral finance as two sides: one is traditional finance (technical and fundamental), and the other is behavioral. You can’t have a coin without both sides. Whatever analogy you prefer, financial advisors who understand these distinctions can tailor their advice and strategies to better align with their clients’ needs and preferences.

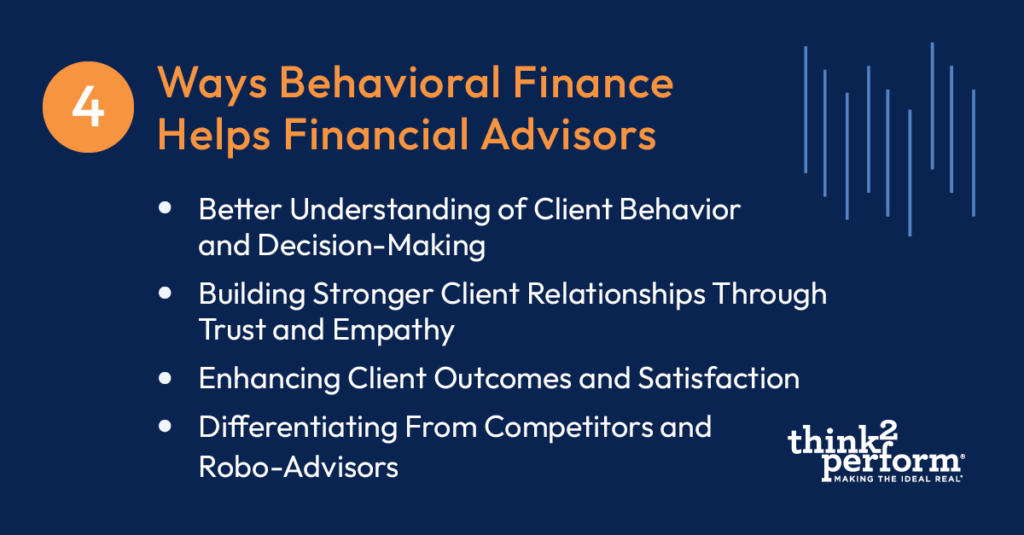

4 Benefits of Behavioral Finance for Financial Advisors

Behavioral finance recognizes the importance of rationality in financial decision-making while acknowledging that life gets in the way. That recognition is just one of the advantages of behavioral finance. Here are some other benefits financial advisors can realize.

Better Understanding of Client Behavior and Decision-Making

When financial advisors have a deep understanding of behavioral finance, they’re better equipped to inquire about and recognize their clients’ behaviors, biases, and emotions. With this new knowledge, advisors can better align their advice to clients’ values, needs, and preferences.

Clients have many ways to plan for their financial future, including doing it themselves or having no plan at all. One way advisors can deliver ongoing value is by recognizing that they’re in a relationship with clients, and they should nurture it. By deepening these relationships, advisors can better anticipate and address potential investing pitfalls, including emotional decisions.

And instead of selling clients the easiest or most basic products, financial advisors can uncover tailored solutions that also make financial sense.

Building Stronger Client Relationships Through Trust and Empathy

Clients worry about the future, especially as they get to the later stages of their lives. Finances matter, but that’s not the only consideration. Behavioral finance helps advisors center their relationships with clients in trust and empathy rather than just dollars, figures and financial optimization.

“Advisors still tend to gravitate toward talking about performance and products,” says Chuck Wachendorfer, president of distribution at think2perform. “Resist the urge to do so and focus on what your clients are concerned about — cost of health care, long life and maintaining their lifestyles.”

One way advisors can show empathy is by taking a step back. Before offering your recommendations, listen. Understand more of what’s driving your client’s feelings and decisions. Ask questions like, “What are you worried about in the future?” and “What can we do about preparing for the future?”

Enhancing Client Outcomes and Satisfaction

When clients make rational and informed decisions, they move toward long-term financial success in ways that match their values. They might do this without behavioral finance — but they might not. Instead, they might overreact to every shift in stock prices or go big in speculative plays they don’t understand because they get caught up in the moment.

The discipline of the behavioral finance approach, meanwhile, makes it a powerful tool for financial advisors who want to help clients lock into better thinking and better behaviors for better outcomes.

Clients’ outcomes and satisfaction improve when they realize they have a financial advisor who not only looks out for them but also has a solid plan. Moreover, because behavioral finance aligns financial decisions with values, clients are less likely to feel steered or manipulated by their advisors. This simple change in advisor satisfaction can be a catalyst for retention and referrals.

Differentiating From Competitors and Robo-Advisors

Behavioral finance creates a value proposition that differentiates you from competitors and robo-advisors. While robo-advisors may offer automated investment solutions, they lack the human touch and personalized guidance that behavioral finance can provide. And even a robo-advisor can’t stop someone from undoing automated decisions because of emotionally driven fears.

“Getting clients ready for the uncertain by helping them understand their own thinking is really what advisors must do to remain relevant in a world where they are going to compete on price with these robo-advisors,” Lennick says.

Overcoming Challenges With Behavioral Finance

Behavioral finance can be a big change for advisors and clients alike. Common challenges include resistance to change, difficulty understanding the concept and struggles with integrating behavioral finance into existing approaches. Here are a few ways financial advisors can deal with implementation challenges.

Addressing Client Resistance and Skepticism

The onus is on financial advisors to illustrate the benefits of any new approach, including behavioral finance. They can address client resistance and skepticism through clear communication about the principles and benefits. Talk about why you find the approach so valuable, and share real-life examples so they can visualize it for themselves.

Clients also might be skeptical of the advisor’s ability to implement this approach. Show them what you’ve done to educate yourself on this approach, such as taking the Behavioral Financial Advice program. Don’t just rely on credentials, however; share success stories from other clients. Illustrate how behavioral finance has changed your life and outlook.

Additionally, emphasize how behavioral finance is a personal journey for everyone. Introduce behavioral finance concepts gradually at the client’s pace. Help them get comfortable and see how you work on their behalf based on their values, needs, preferences and circumstances.

Integrating Behavioral Finance Into Existing Processes

Behavioral finance is a different way of looking at clients’ financial decisions, and your existing processes might not fully align with this approach. Assess your current practices and identify areas where you can incorporate behavioral finance principles.

For example, is your client onboarding heavily focused on numbers and investment portfolios? You might need to build in more time for conversation, trust-building and values exploration. Similarly, you don’t have to introduce this approach to every client right away. You might start with new clients, bringing along your existing roster during annual reviews or other key touch points.

Applying behavioral finance to your practice also could result in you re-evaluating the investment selection process, risk assessment methods, communication strategies and more. By auditing your existing processes, you can see where behavioral finance principles are already present — and where they can deliver immediate changes with minimal disruption.

Leverage Technology to Support the Change

Technology can be invaluable for financial advisors. Much of this already exists in your practice: communication channels, investing portals, reporting dashboards and so forth.

Additionally, look to incorporate behavioral profiling tools, questionnaires and other information-gathering steps into your client onboarding process that help you better understand clients’ behavioral tendencies. This information can be stored securely for instant access, helping advisors tailor their recommendations to align with clients’ unique circumstances and behavioral profiles.

How to Get Started With Behavioral Finance

Change starts with you. If you want to apply behavioral finance in your practice, you need to lead the way. Once you’ve mastered the principles, you’ll be ready to help your clients. Learn more about some of the habits of successful financial advisors.

Develop Self-Awareness and Emotional Intelligence

Start by understanding your own biases and emotional triggers. Reflect on your decision-making processes, and identify any patterns of irrational behavior. Self-awareness helps you be a better person and advisor, and it’s also a way to empathize with clients as they go through their own journey.

Cultivate emotional intelligence by recognizing and managing your own emotions and those of your clients. The “4 Rs” process of Recognize, Reflect, Reframe and Respond — and particularly the Reflect step — is one way you can access your emotional intelligence.

“When I reflect on my values and what I care most about, I begin to calm down,” Lennick says. “The process of reflecting and calming down forces the engagement of the cognitive brain, rather than just the emotional brain. It won’t make anyone smarter, but it will increase and improve their access to their intelligence.”

Define Your Values

Clarify your own values and how they align with your approach to financial advising. We know that living out of alignment is a source of stress and dissatisfaction — and that those are just some of the factors that trigger emotional responses and poor decision-making. By contrast, understanding your values, especially your top five, help you decipher past decisions and make better ones going forward.

Our values card exercise comes in a free, interactive online tool and a physical card deck for purchase. You (and your clients) have options for when, where and how you want to sort through and prioritize your values.

Incorporate Behavioral Finance Into Client Interactions

Just as you need to define your values, help your clients do the same. Have them go through the values exercise, either with you or alone. Once your client has determined their values, ask them to define each value and its role in their life.

Your client’s perspective on what a value represents may not match yours, so it’s crucial to fully understand what each value means to your client.

Get proactive with pitfalls. Help clients identify spending behaviors that compromise their goals and are misaligned with their values. Working together, strategize ways they can proactively intervene before slipping up.

Seek Additional Training and Education

Invest in your own professional development by seeking training and education opportunities in behavioral finance. Attend workshops and conferences or take online courses that focus on behavioral finance principles and techniques.

Put Behavioral Finance to Work in Your Practice

Financial advisors are more important than ever, but the world has changed, and so must their approach to investing and client service. Behavioral finance helps advisors reckon with the rational and irrational aspects of investing so they can help clients create better financial plans for their future — and more effectively stick to the plan.

Behavioral finance isn’t just something to push at clients. It’s a practice you, the financial advisor, take part in right alongside them. When you better understand yourself and your values, you’re ready to help others do the same.Ready to invest in yourself and your clients? Check out our BFA offerings.