Investors today are looking for someone to shepherd them through a complex, uncertain and ever-changing financial world. In a world of robo-advisors and other technologies, people continue to crave human guidance. The emphasis is increasingly on relationships — and that’s where behavioral financial advice can be the win-win that helps advisors help clients make better decisions and secure their futures.

Even clients who steer their investment decisions still want a financial advisor by their side. To that point, nearly 50% of clients want more frequent communication from their advisor, according to a YCharts survey. Meanwhile, 28% of financial advisors surveyed by J.D. Power say they already don’t have enough time for clients.

Learn more about what behavioral financial advice is and how to achieve the behavioral financial advisor designation. We’ll also show you how to introduce this value proposition to your clients.

Defining Behavioral Financial Advice

Behavioral financial advice combines traditional finance practices with insights from psychology and neuroscience. Financial advisors who use behavioral financial advice help their clients improve their response to emotions and decision-making behaviors. This approach encourages rational decisions instead of emotional choices, even during turbulent markets and stressful personal moments.

The goal of behavioral financial advice is to help financial advisors have more conversations that connect their client’s values to their financial goals and their financial goals to their behavior — even when those values and financials change over time.

“When advisors are able to get this point of rational decision-making across to clients, the clients are positioned such that whenever they need money, there’s a smart place for them to get it,” says think2perform CEO Doug Lennick.

How Behavioral Financial Advice Differs From Traditional Approaches

Behavioral financial advice differs from traditional approaches to wealth management, retirement planning and other investment strategies because of its emphasis on client behavior and behavioral finance.

Rather than solely focusing on investment performance, advisors must consider the psychological factors that affect decision-making. By understanding clients’ emotions, biases and goals, advisors can provide recommendations that align with their clients’ values and aspirations.

Because this concept is subjective rather than objective, client values can change over time, which changes the recommendations made by financial advisors. The process facilitates conversations that tie client values to their financial plans. As time passes and values shift, reassess what matters to clients and what influences their decisions.

At think2perform, we think of this concept in terms of six behavioral competencies:

- Integrity

- Achievement orientation

- Self-confidence

- Teamwork

- Customer service orientation

- Concern for order and quality

Research has found that the financial advisors and advisor teams that generated superior portfolios not only possessed cognitive and technical aptitude but also moral and emotional competencies. All four facets are important and necessary for advisors who succeed financially for themselves and their clients.

4 Benefits of Behavioral Financial Advice

Incorporating behavioral financial advice into their practice offers several significant benefits for financial advisors and their clients. Here are four of them.

Improved Decision-Making

By understanding clients’ behavior, advisors can help them make more informed and rational decisions. Behavioral financial advice equips advisors with the tools to identify and address cognitive biases and emotional influences that may hinder sound decision-making. For example, economic stress can push clients to abandon long-term plans or take on too much risk.

By helping clients pause and make rational choices in line with their values and financial plan, they enjoy better financial outcomes in the long run.

This also can be an improvement over the industry’s historical focus on selling what’s emotionally easy to get the consumer to buy. People are increasingly looking for advisors who will be real with them, not just sell them the latest products.

Personalized Guidance

Behavioral financial advice allows advisors to address their clients’ unique needs and concerns, not just broad market averages. By considering each client’s behavior, goals and values, advisors can tailor their recommendations to align to them. This personalized approach fosters a deeper level of trust and engagement between advisors and clients, enhancing the overall client experience.

Enhanced Client Satisfaction and Loyalty

When clients feel understood and supported by their financial advisors, their satisfaction levels increase. Behavioral financial advice enables advisors to empathize with clients’ emotions and concerns, creating a more collaborative and supportive relationship. By addressing the behavioral aspects of financial decision-making, advisors can help clients navigate challenging situations with confidence. The result? Greater satisfaction and peace of mind.

The personalized guidance and improved outcomes resulting from behavioral financial advice contribute to increased client loyalty. Clients who experience this approach not only stay with their advisors but also refer them to others.

By consistently demonstrating an understanding of client behavior and providing tailored solutions, advisors build long-term relationships based on trust and mutual success.

Market Differentiation

In an increasingly competitive financial industry, behavioral financial advice sets advisors apart, attracting new clients who value a holistic approach to financial planning and decision-making.

“What behavioral financial advice brings into the picture is the opportunity for the triple win,” Lennick says. “There is no reason why the investor, the advisor and the financial services company can’t all win.”

Educating Yourself on Behavioral Financial Advice

To effectively incorporate behavioral financial advice into your practice, financial advisors should prioritize continuous learning on the latest research and insights in finance and client behavior. Here are some strategies and resources to help financial advisors educate themselves on behavioral financial advice:

Obtain the BFA designation

The behavioral financial advisor (BFA) designation demonstrates your understanding of behavioral finance principles and commitment to practicing them in your work. By taking our Behavioral Financial Advice program, certified financial professionals (CFPs) will earn 20.5 CFP continuing education credits.

This self-directed behavioral finance course has helped countless professionals deliver greater impact to their clients. In fact, 97% of financial professionals report an increase in production.

Take Continuing Education

After obtaining the BFA, financial advisors can maintain this designation by taking 20 BFA CE credits every two years. Make this part of a regular habit of continuing education across a range of interests.

If you lead a team, encourage your employees to pursue learning and education in all forms. Stoke the fire of your people. “When a leader looks at an employee,” Lennick says, “it’s important to look for a flame that represents potential and goodness and then, as the leader, be the bellows that fans that flame.”

Put It Into Practice

The BFA course is meant to be applied in your practice and with your clients. Throughout the coursework, you will be introduced to Behavioral Financial Advice tools and concepts that work as much for your business as they do for yourself. These tools are intended to facilitate discovery, reframing of behaviors and ongoing client service, especially during uncertainty. When you become comfortable with “the certainty of uncertainty,” you’ll be ready to help clients do the same.

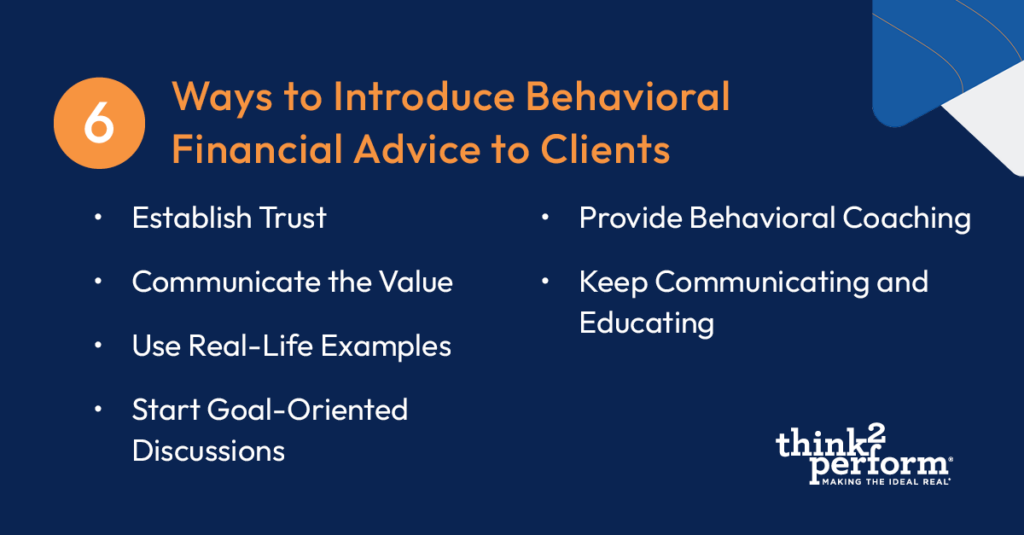

Introducing Behavioral Financial Advice to Clients

Introducing behavioral financial advice to clients requires effective communication and trust. Here are six steps for advisors who want to help clients align their financial choices with their goals and values.

Establish Trust

Building trust is crucial when introducing a new approach to clients. How well do you know and understand your clients? Whatever your level of understanding, you can do more. Listen actively and empathetically to their concerns and goals. Discover or rediscover their default behaviors and whether those align with their values.

By showing genuine interest in their financial well-being, you begin to demonstrate your commitment to helping them achieve their objectives. With this trust established, clients will become open to embracing behavioral financial advice.

Communicate the Value

Articulate the value of behavioral financial advice to clients. Explain how this approach goes beyond traditional financial planning by considering their behavior, emotions and cognitive biases.

Emphasize that by understanding these factors, clients can make better, more rational decisions that contribute to more successful financial outcomes. Moreover, times of instability and stress won’t be as scary because they’ll have a sound approach that eschews panic-driven decisions.

Use Real-Life Examples

Incorporate real-life examples and case studies to illustrate the impact of behavior on financial decision-making. Share stories of how behavioral biases have influenced past clients’ choices and outcomes. This helps clients understand the relevance and importance of considering behavior in their own financial decisions.

Go further by helping clients understand why they do what they do. Walk them through the recent past — have their goals changed because of their behaviors? When you can illustrate how values shape behaviors and how behaviors shape goals and outcomes, clients will realize how this approach can help them.

Start Goal-Oriented Discussions

Shift the focus of client meetings from solely discussing investment performance to goal-oriented discussions. Help clients identify their values, aspirations and long-term objectives. By aligning financial decisions with their goals, clients can see the direct connection between their behaviors and achieving their desired outcomes.

This process won’t necessarily be immediate or permanent. Acknowledge that the plan may need adjustments over time. Move the conversation forward with questions such as:

- What do you think your other options are?

- Do you mind if I weigh in with what I think your options are?

Provide Behavioral Coaching

Offer behavioral coaching to clients as part of your services. This involves guiding clients through the process of recognizing and managing their behavioral biases and emotions. Help them develop strategies to overcome impulsive decision-making and stay focused on their long-term goals.

By incorporating behavioral finance into your core services, clients will accept this approach as standard, making them more comfortable with the practice and your overall expertise.

Keep Communicating and Educating

Continuously educate clients about behavioral finance concepts and how they can apply them in their financial lives. Share relevant articles, books or other resources that can deepen their understanding of behavior-driven decision-making. Encourage clients to ask questions as they chase learning and growth.

Embracing concepts such as behavioral financial advice shows that you remain curious and watchful, which can spur your clients to keep investing in their financial education.

Align Values With Financial Behaviors

When financial advisors add behavioral financial advice to their core offerings, they embrace a science-backed, client-first approach to financial planning that empowers clients to take control of their futures. Instead of making decisions based on emotions, clients act on their values, which helps them generate the outcomes they desire.

In this age of AI and automation, clients need personalized communication, support and guidance more than ever. Behavioral financial advice gives you a powerful tool for meeting clients’ emotional needs while guiding them to more rational decisions.

Ready to invest in yourself and in your clients? Check out our BFA offerings.